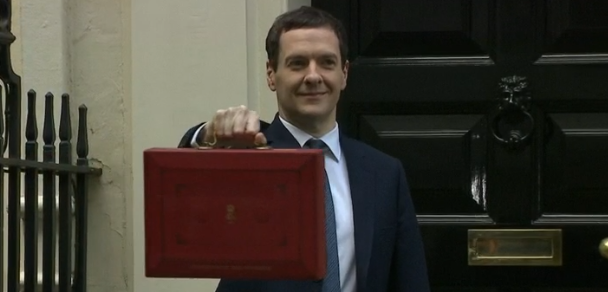

Chancellor George Osborne piled a number of tax giveaways in the arms of small businesses in his Budget 2016.

On a day when he was feeling benign about helping entrepreneurs and business, the only taxpayers to really suffer were contractors who work for their own companies.

From April 2017, he contractor can no longer decide whether they pay tax under IR35 rules or more relaxed ordinary business profit and loss calculations.

Instead, the ‘end user’ makes the tax compliance decision, deducts the right amount of income tax and national insurance and leaves the contractor to argue the merits of the decision with HM Revenue and Customs.

Budget main points for business

Although contractors will feel miffed, Osborne’s other concessions for businesses included:

- Capital Gains Tax slashed

Entrepreneurs and investors have their CGT rates sliced to 18% top rate and 10% lower rate – buy to let landlords and property investors are excluded and keep the current 28%/18% rate.

Expats have reporting limits on no tax transactions extended without incurring penalties

- Corporation Tax cut

A million businesses have their tax rate cut to 17%. The rate has dropped from 28% in 2010.

- Business rates transformed

From April 2017, business premises valued at £12,000 or less is exempt from paying rates. Tapered relief is available for properties with a rateable value up to £15,000

- Income tax changes

All taxpayers see their personal income tax allowance go up to £11,500 in April 2017, while the amount a higher rate taxpayer starts paying at 40% increases from £42,385 to £45,000.

- Commercial stamp duty revamped

Stamp duty on buying a commercial property is aligned with earlier changes to the tax charged on residential property.

Instead of working out stamp duty on the property value, stamp duty is calculated according to tax bandings from midnight on March 16, 2016.

A nil rate band applies to properties worth up to £150,000. Those between £150,000 and £250,000 attract a 2% rate and those above £250,000 pay at 5%.

To work out the stamp duty, split the value into three bands.

For example, a £525,000 property pays no duty on the first £150,000, 2% on the next £100,000 and 5% on the remaining £275,000 – making a total of £15,750.

Read the Budget 2016 Red Book for complete details of economic data and tax changes